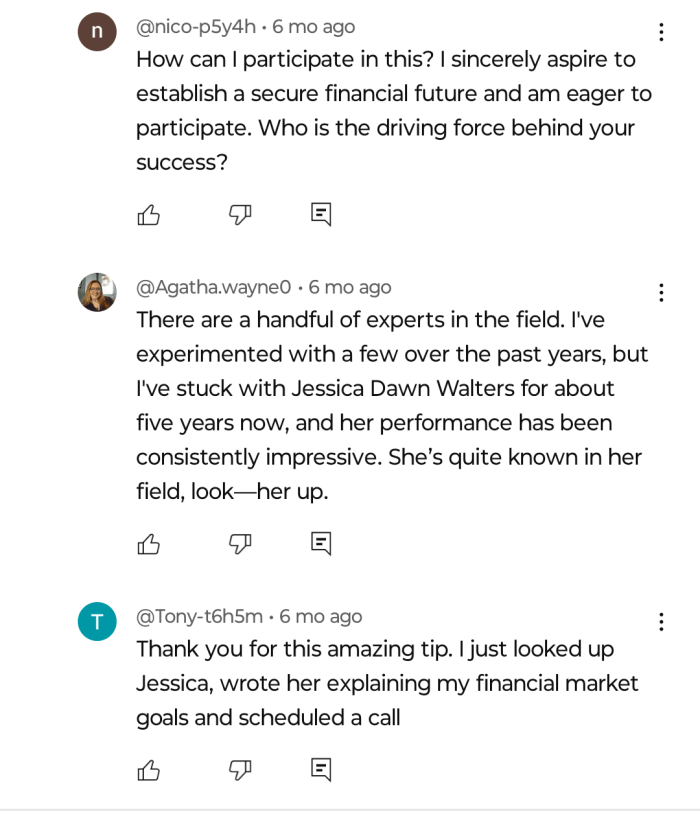

The “Comment Scam Ring” (CSR) is an alarming phenomenon that has become a huge problem on social media. It is most common in the comments section of various popular finance, investing and cryptocurrency related videos on YouTube. Below, I am sharing a random example of one of many such CSRs, which I extracted from the comments section of a video by a popular finance influencer on YouTube who will remain nameless…

Such CSRs prey on unsuspecting and financially inexperienced individuals by creating a false and deceptive narrative of success by luring them into financial schemes that are completely fraudulent. In the case of the above example, a fake non-existent financial expert/adviser called Jessica Dawn Walters is used.

I broached this issue recently with ChatGPT to get some information. The way such a CSR operates is as follows…

Firstly, it starts with “The Setup”, which is the first original comment. In this case…“As an investing enthusiast… I’ve been sitting on over $545K equity…”. This is the “bait comment”. The individual making the comment tries to come across as a genuine investor with a sizeable although not enormous sum of money (In this case $545k to create a false sense of honesty and trust) that they are looking to invest, but are not sure what to do. The goal of this original comment is to be as convincing as possible by targeting individuals in a similar situation.

That first comment is followed by the first reply in the form of “The Helpful Advice”…. “I lack the time… I’ve enlisted the services of a fiduciary…”. The purpose of this reply is to create the “idea” of a trustworthy professional. Many times a “fiduciary” is used that paints a picture of someone responsible and legally bound to work in your interest. This sets the stage for the next step, which is recommending a fake adviser.

But before we get to that stage, there is “The Curious Observer” comment in the second reply….“How can I participate in this?…”. This is the “fake social proof”. Another fake account pretending to be a normal curious person asking for more info. This is simply designed to make the whole comment thread more believable to unsuspecting individuals.

Then we arrive at the fourth stage of this CSR; the third reply in the form of “The Pitch”. This is when the name of the fake financial adviser is dropped…“I’ve stuck with Jessica Dawn Walters for about five years…”. A plain and realistic-sounding name is used to make it all look genuine. However, those who try to research the name via Google will invariably find fake websites and LinkedIn Profiles as well as fake WhatsApp or Telegram numbers.

This is then followed by the final stage in the thread or “The Closer”. In this case in the fourth reply, a fake account comments, “Thank you for this amazing tip…”, further stating that the fake advisor has been contacted and thus adding a deceptive layer of legitimacy to this whole fraudulent operation. Sometimes such a CSR can be on steroids where there are many fake closer comments all endorsing the fake adviser and stating that they have scheduled a call etc.

To many seasoned investors and financial professionals such CSRs instantly appear deceptive and unconvincing. However, there are many individuals who sadly fall for such scams. The relatability, fake sense of trust as well as the triggering of the primal FOMO (Fear Of Missing Out) bug in such people leads them down this shady avenue. Such scams usually result in situations where these victims end up paying up-front “consulting” fees and falling for Ponzi scheme style “high yield” investment offers. In even more severe cases, once one of the victims has engaged in such acts they may be emotionally manipulated via further follow-up contacts and other too-good-to-be-true “returns” schemes to keep them parting with more of their money.

What amazes me is the lack of pro-activity (and action full stop) in dealing with such CSRs by the content moderation teams of the YouTube segment of Alphabet (the parent company of YouTube). It seems that much of YouTube’s content moderation system is automated thus allowing such scams to persist. But sadly such scams are common throughout the entire world wide web, which, since it became mass adopted almost 30 years ago, continues to be a messy wild west space. We can only hope that one day in the future the internet becomes a cleaner and safer space to interact in and where all the harmful and nefarious elements are kept out.

By Nicholas Peart

31st July 2025

(c)All Rights Reserved